Why evidence is the strongest asset to tackle business risk related to illicit flows

Illicit flows are not confined to shadowy corners of the global economy. They

move through financial systems, supply chains, and markets every day, often hidden in plain sight. These flows — whether of money, minerals, labor, or weapons — undermine governance, and create serious risks for companies.

Illicit flows thrive where evidence is weak. Without reliable, verifiable data, decisions on suppliers, partners, and deals carry hidden exposures that can translate into compliance failures, reputational damage, or financial loss.

What are illicit flows?

Illicit flows take many forms:

- Financial flows such as tax evasion, hidden ownership structures, and money laundering.

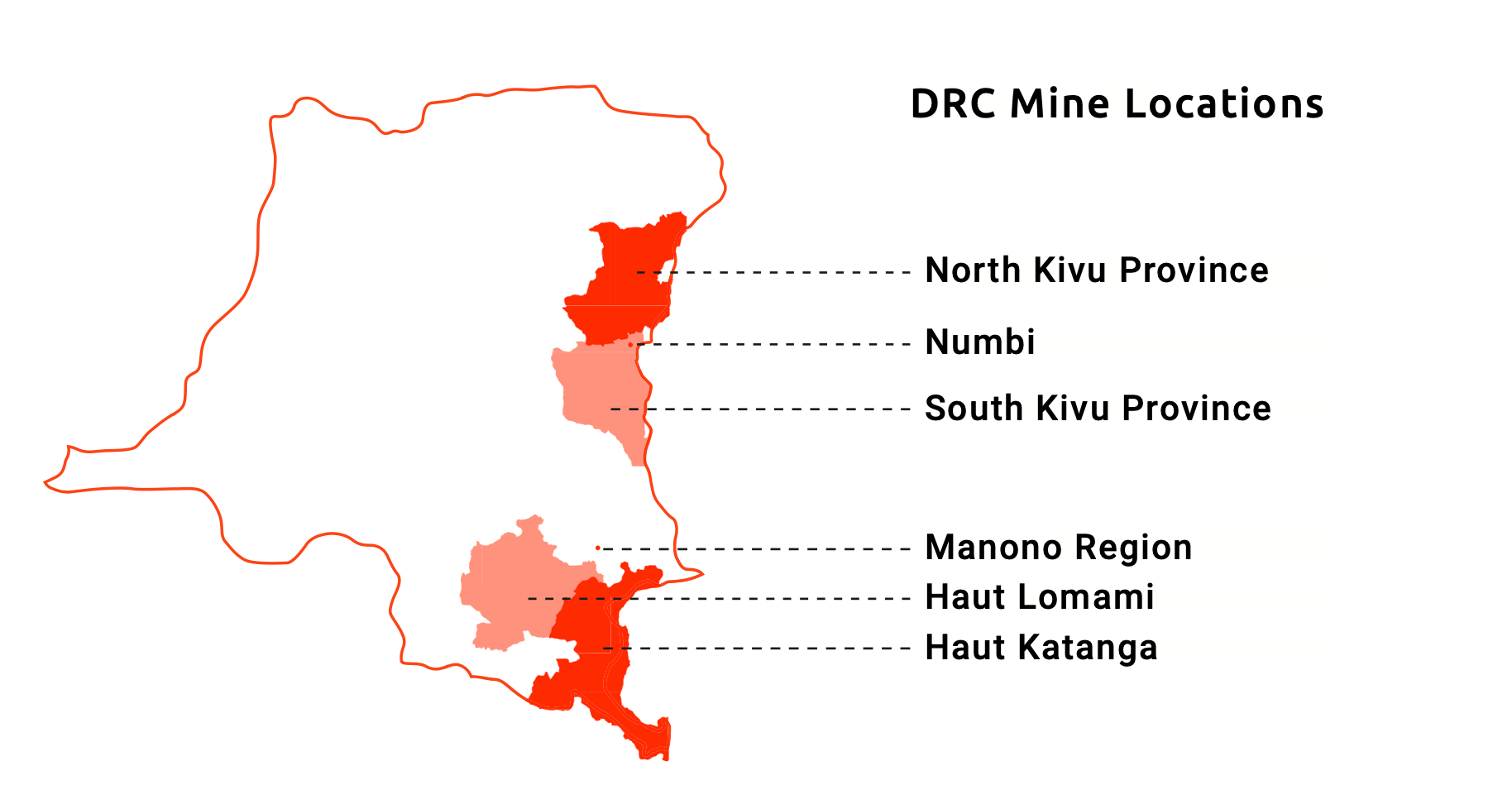

- Commodity flows such as conflict minerals, illicit timber, or counterfeit goods entering legitimate markets.

- Human flows such as forced labor or trafficking in supply chains.

- Arms flows such as weapons diverted into the hands of non-state groups, fueling instability.

While these flows may look different, they share a common feature: they exploit gaps in oversight and evidence.

Where transparency and verification are absent, illicit practices blend into legitimate activity.

The evidence gap

Illicit flows persist not only because bad actors are creative, but also because evidence systems are weak in many jurisdictions. In practice, this means:

- Poor record-keeping: transactions, ownership structures, or supply-chain documentation that are incomplete, inconsistent, or deliberately obscured.

- Fragmented oversight: regulators, ministries, or compliance teams holding information in silos that is never connected.

- Inconsistent reporting: obligations may exist on paper — for example, to track commodities or beneficial ownership — but reporting is irregular or unverifiable.

- Opacity by design: shell companies, offshore structures, or informal trade networks that exist precisely to avoid scrutiny.

When evidence is missing or unreliable, illicit activity blends into legitimate business flows. Companies cannot see the red flags, even when they are present.

A striking illustration comes from research into armed conflict in West Africa.

For years, policymakers assumed illicit weapons entered mainly through cross-border smuggling.

Only once systematic data was collected did the real pattern emerge: most weapons were being diverted internally from state stockpiles.

The same logic applies across business sectors.

If mineral consignments are not tracked with credible chain-of-custody evidence, illicitly mined or conflict-tainted material enters global supply chains. If beneficial ownership registries are incomplete or unreliable, companies can be unknowingly exposed to sanctioned actors.

If suppliers only provide partial documentation, forced labor or corruption risks can be hidden.

Why businesses should care

For companies, illicit flows are not an abstract problem. They directly affect operations, markets, and long-term growth. The risks typically manifest in three ways:

- Regulatory exposure: Companies may inadvertently breach sanctions, anti-money laundering rules, or trade restrictions.

- Operational disruption: Supply chains can be broken when illicit practices are exposed, forcing abrupt changes in sourcing or partnerships.

- Reputational harm: Being linked to corruption, trafficking, or conflict undermines trust among customers, investors, and regulators.

The financial and reputational costs of reacting after problems surface are almost always higher than the cost of investing in strong evidence systems upfront.

Building resilience through evidence

The way to counter these risks is not only through stricter enforcement or more regulation. The first line of defense is evidence.

Structured, verifiable, and comprehensive data through collecting and validating information give companies the visibility they need to act with confidence. They make it possible to:

- Map exposure across supply chains, partners, and markets

- Stress-test potential deals and partnerships against hidden risks

- Provide assurance to regulators, investors, and customers that due diligence is robust

Evidencity equips companies to see through opacity. We provide unique data that is verifiable, actionable, and comprehensive — covering financial structures, supply chains, illicit networks and partner risks. By strengthening access and visibility, we help companies reduce their exposure to illicit flows and make decisions that support sustainable growth.