Supply chain enforcement in 2025: Why the cost of non-compliance is rising fast

The past year has marked a turning point for corporate supply chain due diligence. Across the EU, UK, and US, regulators and courts are beginning to show that “light touch” expectations are over. Companies that fail to identify and act on forced labor or human rights risks are increasingly facing real costs — whether through fines, blocked shipments, or court-ordered corrective measures.

At Evidencity, we track these developments closely, because we believe that investing in data-driven due diligence is cheaper than the price of inaction.

The Road Ahead

- In the EU: The Corporate Sustainability Due Diligence Directive (CSDDD) is expected to be adopted by 2025/26, with obligations phased in from 2028. This will mandate human rights and environmental due diligence across global supply chains.

- In the UK: Lawmakers are pushing hard for mandatory due diligence legislation and an import ban. New laws could be on the table by 2026.

- In the US: Enforcement of UFLPA will only intensify, with more high-risk sectors added and potential reforms to close loopholes like the de minimis import exemption.

By 2027, when the EU’s forced labor ban becomes operational, global companies will be operating under a far more hostile enforcement environment than ever before.

Enforcement in 2025: What happened in numbers

United States – UFLPA reshapes global sourcing

- According to U.S. Customs and Border Protection (CBP), as of August 1, 2025, more than 16,700 shipments valued at nearly USD 3.7 billion have been stopped under the Uyghur Forced Labor Prevention Act (UFLPA). Over 10,000 shipments worth nearly USD 900 million were denied entry.

- In the first half of 2025 alone, 6,636 shipments were detained — already surpassing all of 2024 . Automotive parts made up 86% of all detentions, forcing carmakers to urgently re-map suppliers.

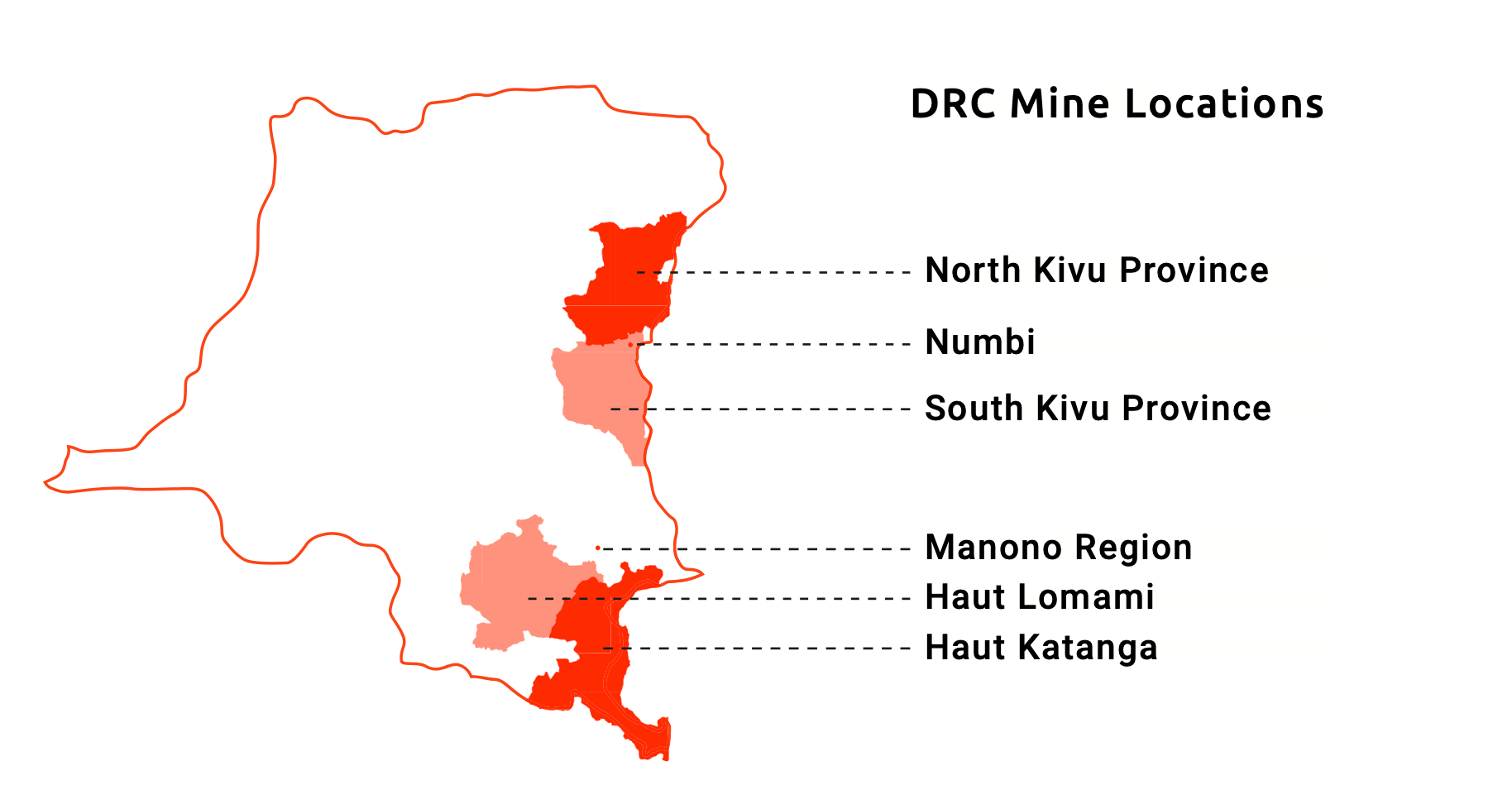

- UFLPA, in force since June 2022, creates a rebuttable presumption that any goods linked to Xinjiang are made with forced labor, unless importers can prove otherwise. In 2025, DHS expanded enforcement priorities to steel, copper, lithium, aluminum, and red dates, widening the sectors under scrutiny.

European Union – building a legal architecture

- France’s Duty of Vigilance Law produced its first major conviction when the Paris Court of Appeal ordered La Poste to revise its vigilance plan (December 2023, upheld June 2025) . In Germany, BAFA received 30 complaints covering 40 companies, launching six investigations under its Supply Chain Act.

- The German Supply Chain Due Diligence Act (LkSG) entered into force in 2023, applying to companies with ≥3,000 employees (expanded to ≥1,000 in 2024). Penalties can reach EUR 8 million or 2% of global turnover.

- The EU Regulation on Prohibiting Products Made with Forced Labor entered into force in December 2024. Enforcement will begin on 14 December 2027, when authorities can seize and remove goods from the EU market .

- Europe is layering enforcement — national regulators are already active, EU-wide bans are on the horizon, and sweeping due diligence duties are to follow, despite discussions on simplification.

United Kingdom – still lagging, but change is coming

- According to the UK Parliament’s Joint Committee on Human Rights, no fines or prosecutions have ever been issued under the Modern Slavery Act .

- The Modern Slavery Act 2015 only requires companies to publish annual transparency statements — even “no action taken” statements are allowed. In March 2025, the government issued new guidance pushing firms toward better disclosure, but without legal force. In July 2025, Parliament’s Joint Committee called for a mandatory due diligence law with stiff penalties and a forced labor import ban within 12 months .

- The UK risks becoming a “dumping ground” for forced labor goods if it does not legislate. The momentum suggests new laws could arrive by 2026.

Our Take

For decision-makers, the lesson from 2025 is unambiguous:

- The rules are multiplying. What was once voluntary CSR is becoming hard law.

- The penalties are growing. From multi-billion-dollar U.S. shipment seizures to EU turnover-based fines, regulators are raising the stakes.

- The window to prepare is closing. By 2027, non-compliant supply chains will not just face reputational risk. They will also lose access to major markets.

Evidencity equips organizations with the data they need not only to comply, but to mitigate risks early, and stay ahead of fast-moving regulatory demands through dynamic insights for the present and the future.