How Congo's Gold Keeps Finding Its Way to Dubai

A new investigation reveals the UAE joint venture meant to clean up Congo's gold trade sourced from conflict zones, never published due diligence reports, and traced back to one of Abu Dhabi's most powerful figures. When the deal collapsed, the gold found a new route — through Rwanda.

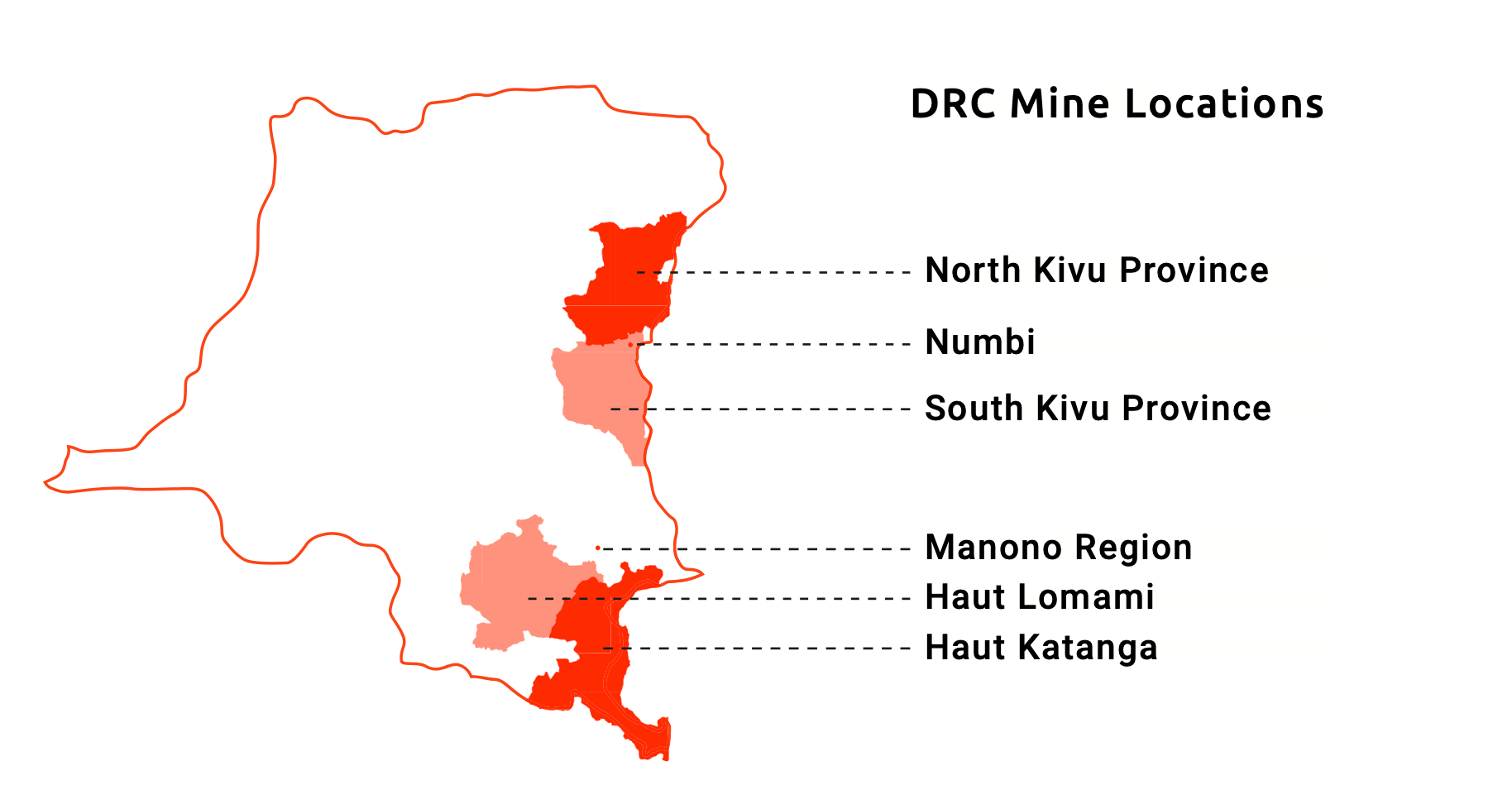

In 2023, a joint venture between the Democratic Republic of Congo and the United Arab Emirates exported more than five tonnes of artisanal gold from South Kivu province — over $300 million worth of precious metal, shipped to a refinery in Abu Dhabi. Primera Gold DRC SA was pitched as the solution to decades of gold smuggling from Congo’s conflict-ravaged east: a state-backed monopoly that would formalize the trade, capture tax revenue, and starve armed groups of their financing.

A

two-year investigation by the Global Initiative Against Transnational Organized Crime, published in January 2026, found something different. Researchers documented gold flowing into Primera Gold’s supply chain from mines where armed groups collected taxation, where children worked alongside adults, and where illegal dredging operations carved through the Itombwe Nature Reserve. Primera Gold never published a single due diligence report. Revenues from the DRC government’s 45% stake never appeared in state budgets. And the corporate structure behind the venture traced back to one of the most powerful men in the Gulf.

The venture collapsed in 2024. The gold didn’t stop flowing. It just found another door.

The Architecture of Access

Primera Gold DRC SA was born from a 2021 cooperation agreement between Kinshasa and Abu Dhabi — a deal in which the UAE provided military equipment and training to Congo’s army in exchange for exclusive mineral rights. By December 2022, the joint venture was formalized: the DRC government held 45%, while the UAE-registered Primera Group Limited held 55%, with exclusive rights to purchase artisanal gold from South Kivu. The contract ran 25 years and granted Primera Gold a 0.25% export tax — a fraction of the 6% rate paid by competitors. UN experts later concluded this created a “de facto monopoly” on legal artisanal gold exports.

The preferential terms were striking. The corporate structure behind them was more so. Primera Group Limited was represented by Sibtein Alibhai, whom UN investigators had previously linked to AR Gold — a company documented buying gold from areas controlled by the NDC armed group as far back as 2012. Alibhai went on to become chief global strategist at International Resources Holding — a subsidiary of International Holding Company, the Abu Dhabi conglomerate chaired by Sheikh Tahnoun bin Zayed Al Nahyan, the UAE’s national security advisor. Primera Group Limited itself operated from the headquarters of Royal Group — also chaired by Sheikh Tahnoun. The designated refinery for Primera Gold’s exports, Auric Hub Ltd, was run by IRH’s CEO Ali Alrashdi.

This was a state-intelligence architecture dressed in corporate registration documents.

The Pattern Across Minerals

Evidencity’s

Project Tantalusreport documented the same pattern playing out simultaneously in tantalum. The same actors — the same corporate vehicles, the same UAE state-linked interests — pursued exclusive rights over Congo’s 3T minerals (tin, tantalum, tungsten) through a parallel venture, Primera Metals DRC. The operational playbook was identical: military cooperation securing mineral access, preferential terms locking out competitors, and supply chains running through conflict-affected eastern provinces with minimal independent oversight.

What

Project Tantalusrevealed in tantalum, the GI-TOC’s investigation now confirms in gold: a systematic approach to securing Congo’s mineral wealth through structures designed to concentrate control while diffusing accountability.

The Pivot

The UAE exited Primera Gold in August 2024. The DRC government assumed full ownership, renaming the company DRC Gold Trading SA by November. On paper, the story ended — a failed experiment in formalized gold trading.

Then M23 changed the map. Rwanda-backed rebels seized Goma in January 2025 and Bukavu — the capital of South Kivu and Primera Gold’s operational hub — in February. By March, DRC Gold Trading SA suspended purchasing operations in Bukavu entirely. The company had exported just 200 kilograms in January 2025 against a target of 16 tonnes for the year. South Kivu, which accounted for over 90% of the country’s official artisanal gold exports, went dark.

The gold didn’t vanish. Rwanda exported 19.4 tonnes of gold in 2024, earning $1.5 billion — despite domestic production estimated at roughly 2.9 tonnes. The UAE remained a primary destination. In March 2025, the EU sanctioned Rwanda’s Gasabo Gold Refinery for transiting illegally mined Congolese gold, along with the head of Rwanda’s mining regulator. President Kagame publicly acknowledged that some of Rwanda’s gold originates in Congo, framing it as regional trade rather than smuggling.

The geography of the gold pipeline shifted. Its terminus in the Gulf did not.

The Due Diligence Blind Spot

For companies sourcing gold that transits through the UAE, the Primera Gold story exposes a structural vulnerability in conventional screening. A standard entity-level check on DRC Gold Trading SA today returns a state-owned Congolese company — no OFAC designations, no Interpol notices. Run the same check on Auric Hub Ltd, the Abu Dhabi refinery that processed Primera Gold’s exports, and nothing flags. The sanctions, the armed groups, the child labor, the missing revenues — none of it surfaces in a database query.

The EU’s Corporate Sustainability Due Diligence Directive, which enters phased application from 2028, will require large companies to identify and mitigate adverse human rights and environmental impacts across their value chains. The EU Conflict Minerals Regulation already demands supply chain due diligence for gold imports. Yet Primera Gold operated for over a year — exporting $300 million in gold from documented conflict-affected areas — without publishing a single due diligence report required under Congolese law. No ICGLR audit of its operations was ever conducted.

The question for compliance teams isn’t whether Primera Gold failed. It’s whether their current screening tools would have caught it. As Evidencity’s

Project Tantalusdemonstrated, the relationships connecting conflict minerals to global markets don’t announce themselves through sanctions lists or adverse media hits. They live in shared directorships, overlapping corporate addresses, and debt obligations between shell entities registered across multiple jurisdictions. Seeing them requires mapping networks, not screening names.

The Door Doesn’t Close

Primera Gold was supposed to be the front door — the legitimate, state-sanctioned channel that would bring Congo’s artisanal gold into the formal economy. It lasted two years. The supply chain it built ran through conflict zones. The revenues it generated disappeared from state budgets. The corporate architecture behind it connected a Congolese joint venture to the private interests of one of the Gulf’s most powerful figures.

When that door closed, the gold found another route — through Rwanda, through Gasabo, and back to the same refineries in the UAE. The pipeline’s geography shifted. Its destination did not.

For companies with exposure to gold supply chains terminating in the Gulf, conventional entity screening won’t reveal this infrastructure. Evidencity’s Illicit Network Intelligence maps the relationships — between shell companies, shared directors, debt obligations, and overlapping corporate addresses — that connect conflict-affected mining areas to global markets.

Project Tantalusdemonstrated this capability across tantalum. Primera Gold confirms the pattern extends to gold.

The question isn’t whether your supply chain touches this network. It’s whether your due diligence tools can see it.