OFAC sanctions hit key players in the tantalum trade

In April 2025, Evidencity's

Project Tantalus identified East Rise Corporation, a Hong Kong–registered trader, within a global tantalum supply chain that connected a major Kazakh refiner to questionable mining and trading operations in the Democratic Republic of the Congo (DRC) and Rwanda.

In August 2025, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC)

sanctioned

East Rise, along with several other actors, confirming our team's findings.

At the time of Evidencity's research, East Rise was not subject to any enforcement action, but the network it occupied featured companies and individuals long associated with high-risk mineral sourcing.

Corporate records tied East Rise’s management to John Crawley, a UK-born mining executive whose ventures have repeatedly intersected with tantalum supply chains in conflict-affected areas. These ventures include Niotan Inc. (later known as Kemet Blue Powder and acquired by Kemet Corporation), Noventa Ltd., Premier African Minerals Ltd., Mineral Resources International, Metal Processing Congo SPRL, and Congo Fair Mining. Crawley’s network has also overlapped with that of Christopher Huber and Simeon Briskin, both of whom have been involved in mineral washing through Rwanda. Importantly, Huber was being investigated for war pillaging by the Swiss authorities.

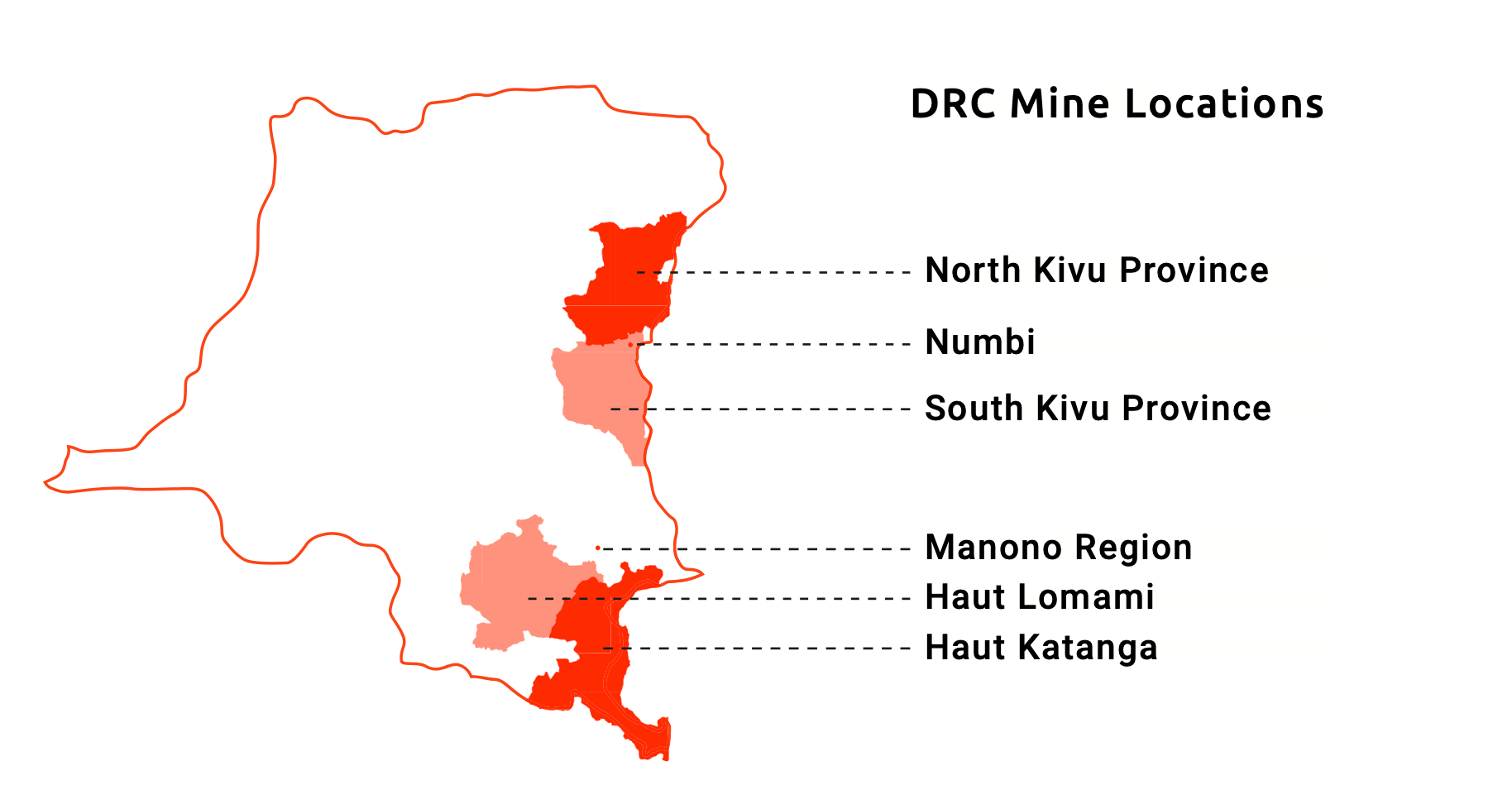

Within this network sat the Cooperative des Artisanaux Miniers du Congo (CDMC), the largest mining cooperative operating in Rubaya, North Kivu — one of the richest tantalum deposits in the world. Part of Rubaya’s concessions were recently operated under Congo Fair Mining (CFM SA), a joint venture formed in 2020 between state-owned company SAKIMA and CDMC. The cooperative was previously chaired by Mr. Crawley. Through this structure, Crawley had a direct link to the JV’s operations, although in recent years, he appeared to be linked mainly to East Rise Corporation.

Rubaya has been notoriously under the influence of armed groups, including PARECO-FF (Patriotes Résistants Congolais – Front du Peuple), a splinter of the broader PARECO coalition active since the mid-2000s. Comprised largely of Hutu, Hunde, and Nande militia groups, PARECO-FF has been implicated in illegal taxation, forced labour, and child labour. Minerals from these sites are often moved through Rwanda before entering international markets.

CDMC’s reach meant that minerals from these concessions — despite being sourced in areas under armed group influence — could enter the international market through legitimate-looking export channels. From there, shipments could move to traders such as East Rise Corporation, which in turn supplied smelters, including Ulba Metallurgical Plant JSC in Kazakhstan, which is a major midstream company in the global tantalum supply chain and is ultimately owned by the Kazakh state.

Risks confirmed

On 12 August 2025, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned East Rise, CDMC, and another Hong Kong trader, Star Dragon Corporation, which is also affiliated with Chris Huber and John Crawley. OFAC confirmed that East Rise and Star Dragon purchased minerals from CDMC, whose sourcing from PARECO-FF–controlled areas provided financial benefit to armed actors and contributed to regional instability.

These sanctions are not an isolated compliance action. They fit into a long-standing pattern of activity by a recurring set of actors and companies operating in high-risk tantalum supply chains — a pattern already mapped by Evidencity.

The designation of East Rise confirms that the risk and pre-sanction indicators identified in the research were both accurate and material, underscoring the persistence of networks that enable conflict minerals to reach global markets despite due diligence frameworks and industry audits.

Tantalum is critical for electronics, aerospace, and medical devices, valued for its durability, conductivity, and corrosion resistance. But as both the sanctions and earlier research highlight, when its sourcing runs through conflict-affected regions, this essential material becomes part of the financial lifeline sustaining armed groups and exploitation far from the end market.

For companies relying on tantalum, these links present not only compliance challenges but also

serious reputational risks. Even indirect connections to sanctioned entities or conflict-affected supply chains can damage brand trust, invite shareholder scrutiny, and disrupt customer relationships.