Brazil’s tantalum test: Viable alternative or risky bet?

Brazil is increasingly touted as a cornerstone of the global critical minerals trade. Long known for iron ore and niobium, the country is now seeking to expand its role in supplying the minerals that power the energy transition and high-tech industries, attracting international interest.

Lithium, rare earths, and graphite dominate headlines. However, tantalum, a strategic metal used in electronics, aerospace alloys, and medical devices, may be another under-examined opportunity for Brazil.

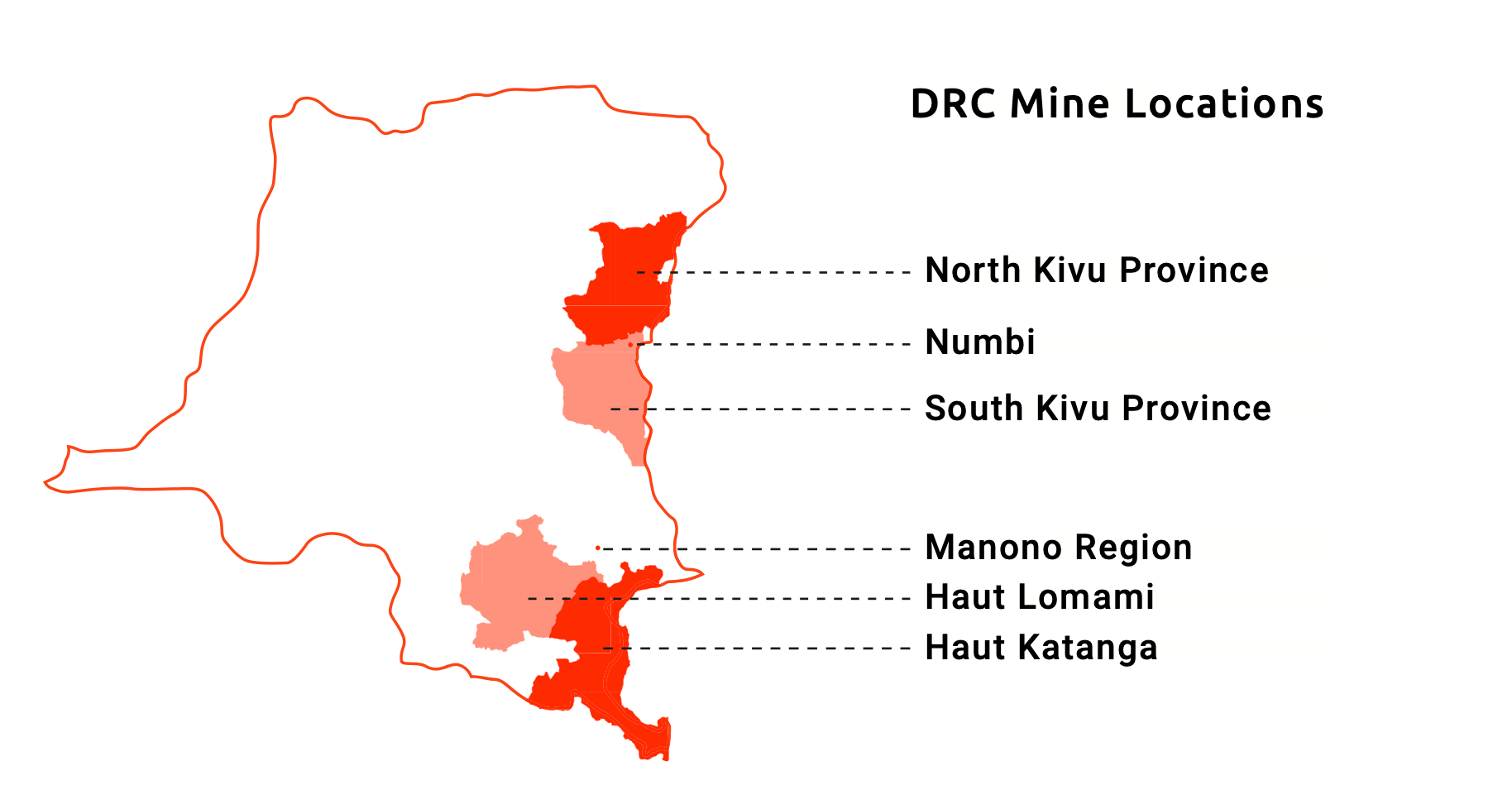

Tantalum’s global supply is notoriously fraught. Roughly 41% originates in the Democratic Republic of the Congo (DRC), where artisanal mining is linked to forced and child labour, armed groups, and opaque trading practices, as confirmed by Evidencity's Project Tantalus. Smuggling across borders to “wash” Congolese ore as Rwandan exports is a common practice. All this with heavy Chinese involvement in the mid-stream part of the supply chain.

In this context, Western policymakers and manufacturers are eyeing Brazil as an alternative source: a country with industrial mining, a renewable-heavy power grid, and democratic legitimacy.

Brazil’s tantalum industry

Brazil consistently ranks among the world’s top tantalum producers, typically third after the DRC and Rwanda (USGS, 2023). Most of its tantalum is mined as a by-product of other operations. In addition, two companies anchor the country’s midstream capacity: AMG Brasil and Mineração Taboca.

At its Mibra mine, AMG produces lithium and tantalum concentrates. In 2023, AMG signed a long-term supply agreement with Germany’s Taniobis GmbH to expand tantalum output from 320,000 to 380,000 pounds per year, supported by nearly 100 million Brazilian real in new investment. AMG has also secured a Responsible Minerals Initiative certification, positioning its tantalum as conflict-free.

On the other hand, operating the Pitinga mine in Amazonas, Taboca produces tin, niobium, and tantalum, with refining facilities in São Paulo. In late 2024, Peru’s Minsur sold Taboca to China’s state-owned CNMC for about USD 340 million. Pitinga is among the largest global sources of tantalum-bearing columbite, making the acquisition geopolitically significant.

This dual role — ore production and midstream refining — gives Brazil a rare position. For buyers under pressure to diversify supply chains, that is a strategic advantage.

Lula’s strategic minerals doctrine

The current administration of Luiz Inácio Lula da Silva has elevated critical minerals to the level of sovereignty.

“We won’t allow what happened in the last century — exporting ore and buying back expensive products. We want the value to be added here in Brazil,” Lula said in 2025, framing minerals policy as a matter of independence.

He highlighted that 70% of Brazil’s territory remains unmapped and announced the establishment of a special commission to survey the nation’s subsoil under state control.

Policy has followed rhetoric. In 2024, Congress introduced Bill 2780/2024, establishing a National Policy for Critical and Strategic Minerals (PNMCE). The proposal includes tax breaks, credit lines, and a high-level committee to coordinate strategy (Agência Câmara, 2024). The National Mining Agency (ANM) also established a division for critical minerals, committing to streamline licensing while enhancing oversight.

Brazil has done this before: niobium is a case in point. Through Companhia Brasileira de Metalurgia e Mineração (CBMM), Brazil controls approximately 97% of the global supply, leveraging production partnerships and long-term contracts to enhance its market position.

Tantalum may not replicate niobium’s dominance, but the precedent shows that Brazil can capture downstream value when strategy and execution align.

The credibility test

Opportunities aside, Brazil’s tantalum supply chain faces scrutiny. Illegal mining and laundering — long associated with gold — are now surfacing across the critical minerals sphere.

In November 2023, police in Amapá intercepted two tonnes of tantalite ore hidden in a pickup truck, sourced from an unlicensed Amazon mine. Among those arrested was a Chinese national linked to a mineral trading company in Macapá. Authorities described the case as “the tip of the iceberg” of a larger smuggling scheme.

In Roraima, Federal Police in 2023 launched Operation Forja de Hefesto, exposing how cassiterite (tin ore) illegally extracted from Yanomami Indigenous Territory — often occurring alongside columbite-tantalite — was purchased by one of the world’s largest tin smelters. Over just five months, more than 166 million Brazilian real worth of ore was laundered into formal supply chains, mixed with licensed production, and exported as “clean” metal sold to electronics multinationals (Metrópoles, 2023). The buyer affected was said to be White Solder Metalurgia e Mineração.

Moreover, Evidencity's findings through Project Tantalus suggest that, although Brazilian smelters claim 100% local tantalum sourcing, the possibility that conflict-tainted tantalum reaches their facilities through the complex material movements occurring in most global supply chains remains high, as indicated by import and export data.

Geopolitical stakes

For the U.S. and EU, Brazil is an appealing candidate for “friend-shoring.” Its democratic institutions, renewable energy grid, and midstream facilities contrast with China’s dominance and the DRC’s governance vacuum. Brazil has already been courted in Minerals Security Partnership discussions.

At the same time, China remains deeply embedded. The CNMC takeover of Taboca underlines Beijing’s enduring leverage in Brazilian mining. Brasília’s strategy is to pursue a multi-vector approach — engaging East and West alike, but insisting on value addition at home, with recent developments regarding the imposition of tariffs further complicating matters.

Handled well, Brazil's position can lead to a rare “swing supplier” role for critical minerals, with influence across both blocs.

Brazil has the geology, industrial base, and policy momentum to play a much larger role in the critical minerals trade. For tantalum in particular, it offers what buyers crave.

But credibility will remain the hinge. To seize the opportunity, Brazil must strengthen traceability, close enforcement gaps, and ensure its “conflict-free” brand can withstand scrutiny.

If it succeeds, Brazil could move from a marginal tantalum player to a cornerstone of diversified, responsible supply chains. If not, its minerals risk being seen as just another label in a system still haunted by conflict and opacity.