The Human Impact of Cobalt Sourcing

Human rights investigations estimate that at least 25,000 children work in cobalt mines across the Democratic Republic of the Congo.

The scale of modern slavery in the Congolese cobalt sector is devastating: in 2024, the U.S. Department of Labor confirmed that over three-fourths of miners may be operating under forced labor conditions, involving coercion, debt bondage, or other involuntary arrangements.

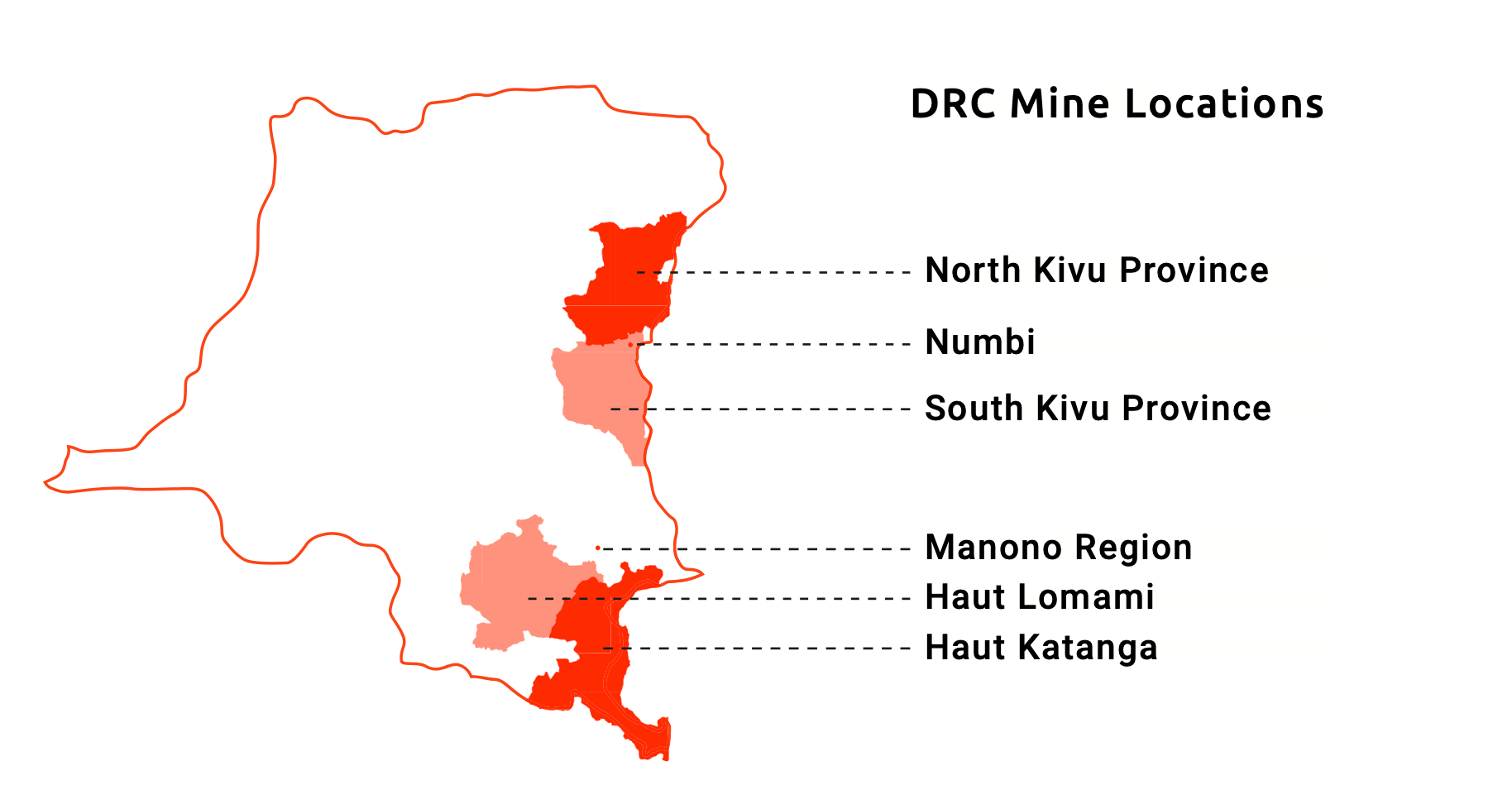

Yet the DRC remains indispensable to the global green transition, producing approximately 70% of the world’s cobalt—an essential component of lithium-ion batteries used in electric vehicles and consumer electronics.

Chinese Dominance and Complicity

In late 2023, a U.S. Congressional commission highlighted the severity of the situation, noting that 80% of cobalt produced in the DRC is controlled by Chinese companies and subsequently refined in China—often under conditions marked by severe labor rights abuses in both mining and processing.

Chinese dominance in the sector is unequivocal: 15 out of the DRC’s 19 cobalt-producing mines are owned or financed by Chinese entities.

Corporate Accountability

Multiple companies have been accused of enabling or directly profiting from child and forced labor in the DRC’s cobalt industry.

A detailed investigation by the Business and Human Rights Resource Centre, published in late 2024, identified key mining operators and corporate structures associated with such abuses.

The report documented forced labor not only in informal artisanal mining sites but also in communities surrounding large industrial operations. It cited several Chinese-led joint ventures and Congolese state-owned firms as being complicit.

Specifically, the companies named included Sicomines, Deziwa Mining (Somidez), Kamoto Copper Company, and Tenke Fungurume Mining. Parent and ultimate parent companies associated with these operations include China Railway Group, Huayou Cobalt, China Nonferrous Metal Mining, China Molybdenum, Metalkol, Eurasian Resources Group, Gécamines, and Glencore.

Role of Traders and Middlemen

Abuse in the cobalt supply chain is not limited to mine operators. Trading firms and intermediaries have also played a key role. For years, Congo Dongfang International (CDM)—a subsidiary of China’s Zhejiang Huayou Cobalt—was the primary buyer of artisanal cobalt.

Amnesty International’s landmark 2016 report linked cobalt from mines known to use child labor directly to CDM, and ultimately into the batteries of major electronics brands. Huayou Cobalt initially deflected criticism but later admitted it “could not rule out” the presence of child-mined ore in its supply chain.

Trading depots around Kolwezi have similarly come under fire for purchasing cobalt with no questions asked, in effect sustaining networks that exploit children.

Some of these depots are reportedly linked to powerful Congolese politicians and military figures, perpetuating impunity within the system.

Profiteers and Political Ties

While specific individuals are seldom publicly named in labor abuse cases—due to legal risks and evidentiary challenges—figures like Dan Gertler exemplify the murky networks operating behind the scenes. The Israeli businessman, long active in the Congolese mining sector, was sanctioned by the United States for corruption.

Although those sanctions did not relate directly to labor abuses, Gertler’s opaque deals with state-owned enterprises diverted public revenues that could have been used to improve miner safety and wages. His role illustrates how entrenched interests have capitalised on the absence of oversight and regulation.

Trade and Market Repercussions

Allegations of modern slavery are now reshaping cobalt trade dynamics and corporate behaviour. Some downstream companies are distancing themselves from high-risk supply chains, while others are investing in ethical sourcing initiatives.

For instance, major automakers like Volkswagen have urged their suppliers to guarantee that no child labor is involved in the production of cobalt. Additionally, concerns over the presence of forced labor in London Metal Exchange (LME) cobalt inventories have prompted some buyers to reject LME-listed contracts altogether.

In response, the LME has introduced responsible sourcing requirements: since 2021–2023, all approved cobalt brands must undergo third-party audits and comply with OECD-aligned standards or risk de-listing.

Toward Ethical Cobalt

What was once a hidden local issue has escalated into a major global concern with broad policy and trade implications. Mounting evidence of forced labor in cobalt mining is prompting structural changes in how global supply chains are governed—from stricter import controls and mandatory due diligence regulations to evolving industry standards on responsible sourcing.

While regulatory progress is gaining ground, the situation on the ground remains dire. The DRC’s cobalt sector is deeply entangled in systemic poverty, weak governance, and geopolitical tension—particularly the growing influence of Chinese interests, which complicates efforts by Western actors to enforce transparency and accountability.

Despite these challenges, momentum for ethical cobalt is building. Consumers, investors, and regulators are demanding greater transparency. Companies—both large and small—are increasingly recognising that ignoring forced labor is not just unethical but also a significant business risk.

Ultimately, whether cobalt becomes a symbol of exploitation or a case study in ethical transformation will depend on sustained action and meaningful reforms.